Frequently Asked Questions

Click on the links below to find answers to the most common questions we receive. If you have a question that is not listed, call us at 888-333-2377 or send an email to development@afsp.org.

Who should I make the checks payable to?

Checks should be made payable to AFSP or the American Foundation for Suicide Prevention. Please complete one donation form per check to ensure proper processing.

Download and complete an Offline Donation Form, then mail the check to:

American Foundation for Suicide Prevention

199 Water Street Floor 11

New York, NY 10038.

Is my donation eligible to be matched by my company?

Many employers sponsor matching gift programs and will match any charitable contributions made by their employees. To find out if your company has a matching gift policy and view their requirements, please visit https://afsp.org/take-action/give-a-gift/matching-gifts/.

Can I make a cash donation? What do I do if someone donates cash to me?

We cannot accept cash donations prior to the event, but you can turn in cash donations during event check-in. We do encourage you, however, to convert your cash donations into a cashier's check and submit it with a completed offline donation form for tracking purposes.

A donation is not appearing on my Fundraising page; what should I do?

Please allow four weeks for any mailed donations (both check and credit card donations) to post to your account.

If your donation does not post within four weeks, please email development@afsp.org.

When I receive a donor's check, should I enter it online?

No. When you receive a donor's check, please mail it with the donation form to the address on the donation form.

Can I set up a recurring donation?

Recurring donations allow donors to donate a set amount once a month for a specific amount of time. Recurring donations usually take about 48 hours until the first donation goes through. Expect to see the next donation come about 30 days after the first donation has posted.

Please note that only the incremental monthly donation will be posted to your fundraising page, not the total pledged sum.

How can I donate to a Participant's campaign?

On the home page of the website, friends and family can locate a participant by using the "Fundraiser Search" box at the top of the page. By typing in the name of the participant, they will be directed to the participant's personalized donation page.

Why is the fundraiser search not finding a Participant that I know has registered?

You must type in the first name or last name of the Participant exactly how it is spelled; you can also use part of the first or last name for a broader search. The search terms are not case sensitive.

How do I see who has donated to my campaign?

Login to your DonorDrive page using the "Account Login" button in the upper right hand corner of the homepage. Use the Email Address and Password that you created when you registered for the event. From here you can then view your donor list and the amounts that have been donated.

Are donations tax deductible?

Yes. All donations are tax deductible to the fullest extent allowed by law. All donations that are made online will receive an email confirmation. You may print this email confirmation and use it as your receipt. All donations of $250 or more will receive a written confirmation at the end of each tax quarter that also doubles as a tax receipt. The IRS accepts cashed checks as a receipt for donations $249 and under.

Can I accept donations in foreign currency?

Yes. But all donations must be received in U.S. dollars. Donations from outside the U.S. may be made online if the donor has a U.S. address associated with a credit card. If the donor does not have a U.S. address, donations must be made by completing your offline donation form. The form should either contain complete credit card information or be accompanied by a check issued in U.S. dollars.

Can donations be made after my event has taken place?

Yes. You may continue to send in donations, even after the event has taken place. The deadline to submit donations for walks occurring in the fall is December 31st. The deadline to submit donations for walks occurring in the spring is June 30th.

How can I make a general donation to the cause?

Of course! Simply choose an event and click the “Donate Now” button on the event page.

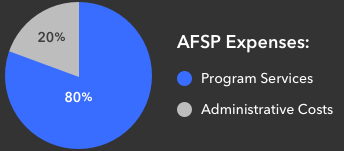

AFSP uses you donations to:

- Fund Research for Suicide Prevention

- Create and Distribute Education Programs

- Advocate for Public Policy

- Support Survivors of Suicide Loss

Thanks to donors like you, AFSP has been able to set a goal to reduce the annual suicide rate 20% by 2025.

What is AFSP’s tax ID number (or EIN number)?

The Out of the Darkness Walks are charitable events run by AFSP, which is recognized as a 501(c)3 not-for-profit organization. The tax ID number or EIN number for AFSP is 13-3393329.

Where can I get a copy of the 501(c)(3) (Not-for-Profit Organization) letter for the American Foundation for Suicide Prevention?

You can download a copy of AFSP's 501(c)(3) letter here.